Single Mom Entrepreneurs: 5 Steps to Build Financial Security While Growing Your Business (Easy Guide)

Building financial security as a single mom entrepreneur feels overwhelming, but it doesn't have to be. You're already proving your strength by running a business while raising your family: now it's time to create the financial foundation that supports both your dreams and your children's future.

The key is balancing immediate family needs with smart business growth strategies. You need systems that work even when life gets chaotic, and you need to maximize every dollar that comes through your business.

Step 1: Master the Strategic Budget That Actually Works

Forget complicated budgeting apps that take hours to maintain. You need a simple system that accounts for your unique situation as both a business owner and single parent.

Use the 50/20/15/10/5 Rule for your total income:

50% for essentials: Rent, utilities, groceries, childcare, transportation, and basic business operations

20% for savings and emergency fund: This is non-negotiable: pay yourself first

15% for flexible expenses: Family activities, subscriptions, business development

10% for growth investments: Education, skill-building, business tools, retirement

5% for unexpected costs: Buffer for those "mom life" surprises

If you're earning $4,000 monthly between your business and any other income, you'd allocate $2,000 for essentials, $800 for savings, $600 for flexible spending, $400 for growth investments, and $200 for unexpected expenses.

Track your spending for just one week to see where your money actually goes. You'll likely discover subscriptions you forgot about or spending patterns that aren't serving your goals. This awareness alone can free up hundreds of dollars monthly.

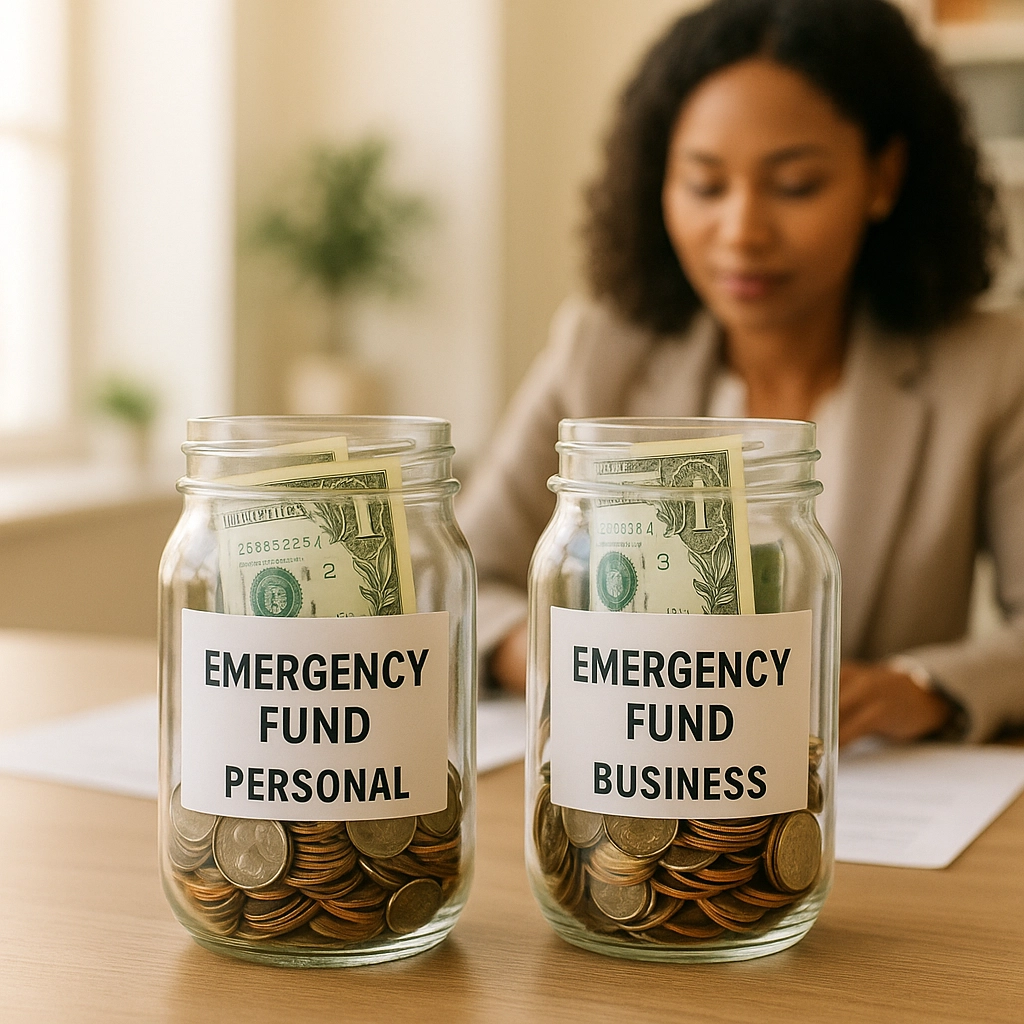

Step 2: Build Your Double-Layer Emergency Fund

Single mom entrepreneurs face unique risks: your income can fluctuate, and you don't have a partner's income as backup. Your emergency fund needs to protect both your family and your business.

Aim for 6-9 months of combined personal and business expenses. This might sound impossible, but start with $1,000 and build from there. Even $500 can prevent you from going into debt when your car needs repairs or your laptop crashes.

Create two separate emergency funds:

Personal emergency fund: 3-6 months of household expenses

Business emergency fund: 3 months of business operating costs

Store these funds in high-yield savings accounts earning 4-5% interest. Don't use regular savings accounts that earn practically nothing: your emergency fund should work for you while it waits.

Automate your emergency fund contributions. Set up automatic transfers the day after you typically receive payments. Even $100 monthly builds to $1,200 in a year, plus interest.

Step 3: Separate and Systematize Your Business Finances

Your business should be your wealth-building machine, but only with proper financial systems. Mixing personal and business finances is one of the fastest ways to create tax headaches and miss growth opportunities.

Open dedicated business accounts immediately:

Business checking account for daily operations

Business savings account for taxes and large expenses

Separate business credit card for expenses and building business credit

Automate your business financial systems:

Pay yourself first: set a regular salary or draw schedule

Automatically set aside 25-30% of revenue for taxes

Create automatic transfers to your business emergency fund

Schedule regular transfers to your business growth fund

Implement the "profit first" method: When money comes in, immediately allocate percentages to different purposes before you spend on anything else. This ensures your business actually builds wealth instead of just covering expenses.

Use accounting software like QuickBooks or even a simple spreadsheet to track everything. You need to know your numbers: what's your monthly break-even point? What's your average customer value? Which services or products are most profitable?